Nearly a third of teachers say they are spending more than £200 a month on travel as fuel costs soar, new figures show.

Almost one in five teachers also report that their household is “scraping by” and not earning enough each month to save any cash.

Fuel costs hit staff

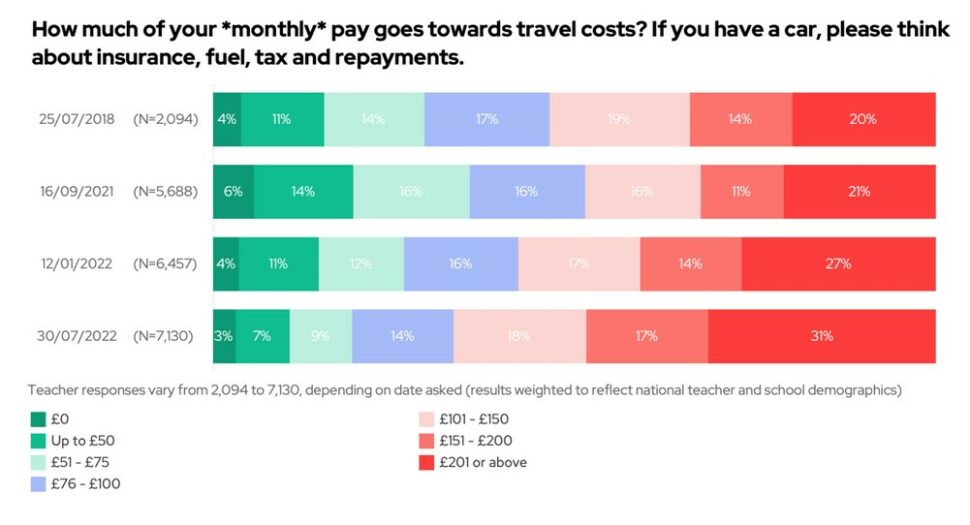

A survey of more than 7,000 staff by Teacher Tapp found 65 per cent of teachers spend at least £101 a month on travel costs, such as fuel, tax and insurance for drivers.

Among them, 31 per cent reported spending more than £200 a month, up from 20 per cent in 2019 – likely reflecting soaring prices at the pumps.

Teachers in state secondary schools, deprived areas or large multi-academy trusts had a higher proportion than average spending £200 or more.

Headteachers were particularly likely to spend such large sums (43 per cent), compared to classroom teachers (28 per cent). Regional divides were also clear, with only 22 per cent of teachers in London spending so much compared to 38 per cent in the north-west.

Previous TT research found 83 per cent of teachers commute by car.

Some teachers ‘scraping by’

The poll on Saturday asked if they and those they live with “earn enough money to live on and save”.

Some 18 per cent of respondents ticked the box marked: “No, we are scraping by…[for example ] sometimes we cannot cover our monthly bills and expenses”.

The figure had stood at 13 per cent as recently as January, amid soaring energy, fuel and food costs.

Teachers working in small multi-academy trusts, secondaries, the most deprived areas, or the south-west were all more likely than average to report struggling. Another 1 per cent said their income falls “well short” of covering monthly costs.

Among staff with children, 23 per cent said they were scraping by. Only 20 per cent said they were living “comfortably”, down from 32 per cent in 2020, while among those without children it fell from 42 per cent to 29 per cent.

“The government may be resistant to paying teachers more, especially in parts of the country where average wages are reasonably low, but the unions are correct when they point out there has been a significant real-terms cut for teacher salaries since 2010,” wrote Teacher Tapp staff on their blog.

“As today’s data shows, that has real implications for people’s household budgets.”

The poll also suggests only 34 per cent of teachers spent under £500 a month on rent or mortgages, down from 39 per cent in 2018. “As interest rates increase on mortgages we are also expecting to see this rise over the next year.”

Research published by the Institute for Fiscal Studies today said most teachers’ pay will still be 12 per cent lower in real terms this year than in 2010, after accounting for inflation. Even teacher starting salaries are reported to be worth at least 3 per cent less.

It comes in spite of a 5 per cent pay award promised in September for experienced teachers, which the government dubbed “the biggest pay rise in a generation”.

There are plans to raise starting salaries to £30,000 too, with an 8.9 per cent salary hike, but the sums appear insufficient to outweigh rising prices and significant pay restraint over the past decade.

There are worries pay offers that fail to match rising costs could exacerbate recruitment and retention challenges, and some heads say rising fuel costs for long-distance commutes are deterring would-be job applicants.

Your thoughts