Government officials have set up a “rapid response” hub to get on the front foot over “serious” academy failures, as the cost of collapsed trusts doubles.

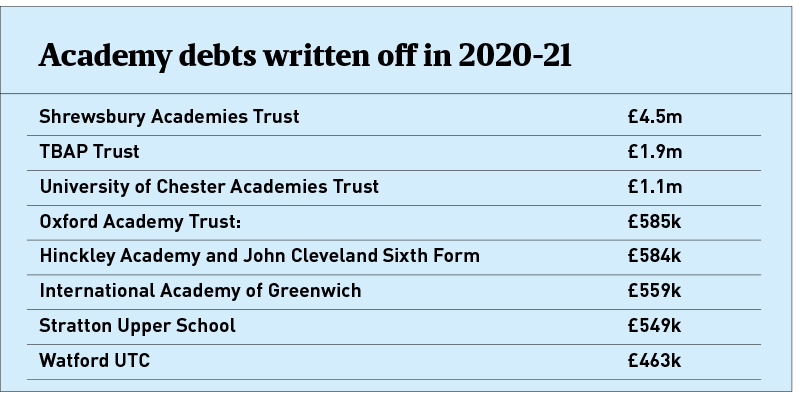

The Education Skills and Funding Agency wrote off more than £10 million on failed academy trusts last year alone. It is more than double the £5 million written off on academy failures in 2019-20.

ESFA annual accounts for the 2020-21 financial year, published on Tuesday, show the agency wrote off debts worth £4.5 million for just one trust alone, the Shrewsbury Academies Trust.

This appears to be the largest write-off for an academy trust since at least 2017.

ESFA hit by biggest ever academy write-off

The government will sometimes waive debts owed by academies as part of their transfer to new sponsors. If trusts close with money still owed to the government, this is also written off.

The Shrewsbury Academies Trust was dissolved last year. All three of its schools were transferred to the Marches Academies Trust.

Annual accounts for 2020 show the trust was reliant on additional government funding and had a £3.7 million deficit.

A financial management and governance review published in 2018 showed the trust had already been handed £2.2 million additional government funding, set against an income of just £7.2 million.

Finance committee minutes cited in the review “raised no concerns… suggesting that the full extent of the trust’s financial difficulties had not been accurately reported or understood”.

In 2015-16, the trust also misused funding for improving school buildings to “support its cash flow”.

Collapsed trust CEO gets job at schools’ new sponsor

The second largest debt write-off, of £1.9 million, was for the TBAP Trust, which gave up its seven alternative provision schools last year after its financial position became “unsustainable”.

Annual accounts for 2017-18 showed the trust had unknowingly racked up a £2.4 million deficit because of a “systematic” failure in its financial systems.

It has also emerged TBAP’s chief executive, Seamus Oates, is now regional director for London at Ormiston Academies Trust – which took on four TBAP schools.

While staff from a rebrokered school normally move over to its new trust, it is less common for central staff from the collapsed chain to make the switch.

Nick Hudson, OAT chief executive, said the schools now provide an “excellent education” and Oates has “played a central role in their success.

“Having both his and his former TBAP colleagues on our team means their knowledge and understanding of these academies is retained and is clearly hugely beneficial for the students,” Hudson added.

Oates said it was a “great opportunity both to work with a trust which has such strong values and to continue to provide [for] some of the capital’s most vulnerable children”. He was “more than happy” to accept the new role.

Rapid response for serious failure

The ESFA has now set up a “rapid response hub to allow greater flexibility and swifter resolution to cases of quick and serious academy trust failure”.

It is part of a push by the organisation to “become less reactive and more preventative in its provider engagement”, accounts state.

Officials spoke to 472 trusts which had forecast declining reserves across the year to “understand the issues and whether any additional help was required”.

Four in five trusts with “serious financial concerns” were “de-escalated within the target time each month, a 9.6 percentage point improvement on performance last year”.

£1.6 million lost on late VAT payment

Meanwhile, ESFA posted “fruitless payments” of £520,000 relating to work staff did on evaluating the feasibility of a successor to the Erasmus+ grant scheme in the run-up to Brexit.

The agency was not chosen as the “preferred delivery partner” so stopped the work.

A fruitless payment is one which “cannot be legally avoided because the recipient is entitled to it even though nothing of use to ESFA will be received in return”.

A £1.6 million fruitless payment was also recorded over a default interest charge levied by HMRC. Accounts state this was for a late VAT payment that related to copyright licences for schools and academies. No further details are provided. The Department for Education did not respond to a request for comment.

An HMRC spokesperson said they “cannot comment on an identifiable taxpayer”.

The DfE buys copyright licences for all state schools – covering “almost all of their copyright requirements” – to save money and administrative time.

Just £4,000 in fruitless payments were recorded last year.

Your thoughts