The government has been urged to show it has the “teeth” to deal with people implicated in major academy finance scandals.

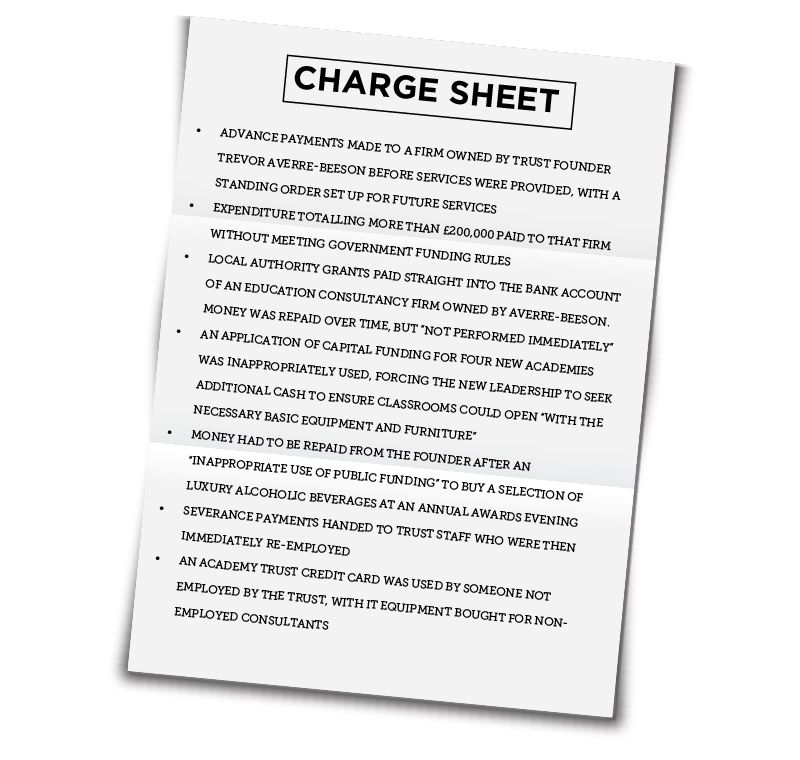

Several instances of financial “impropriety” at the Lilac Sky Schools Academy Trust (LSSAT) have been reported to the Education Funding Agency (EFA), though the government is yet to publish an investigation into financial management at the trust.

Calls are now growing for the EFA to show it has powers to crack down on academy chiefs that break the rules, led by Mary Bousted (pictured), general secretary of the Association of Teachers and Lecturers,

“The key issue here is ‘where are their teeth’,” she told Schools Week.

She added that she hopes that the delayed publication of damning accounts for LSSAT will spark the government into action to restore confidence.

“Is the EFA really holding these trusts to account for their use of public money – or trying to paper over the cracks?” she asked.

“Trusts should not make profits out of state schools. They need to be accountable for their use of public funding.”

The DfE said only that its review into LSSAT is still ongoing – but it’s unclear what action could now be taken.

Previous EFA investigations into academy trusts have resulted in recommendations to improve financial mismanagement. However, LSSAT has already had its nine schools rebrokered, and is due to dissolve.

Several senior educators have called for sanctions against the senior trust members alleged to be responsible for the shocking financial mismanagement borne out in the report.

However Schools Week has been told that senior trust employees such as chief executives don’t fall under the misconduct remit of the NCTL, the regulator which can ban teachers for life.

Misconduct rules only apply to those within “teaching”, which is understood as planning, preparing and delivering lessons, and assessing and reporting on pupils.

The secretary of state does however have powers to ban people from holding any management position in schools, including as a governor, under section 128 of the Education and Skills Act 2008.

It is believed only one order has ever been issued: Tahir Alam was banned in September 2015 for his alleged involvement in the Trojan Horse affair.

Then secretary of state Nicky Morgan said Alam was unsuitable to manage schools because of his conduct “aimed at undermining fundamental British values”.

The four trusts that took over the LSSAT schools are now picking up the pieces. A spokesperson for the Stour Academy Trust, which took on two schools, said the previous financial mismanagement “significantly impacted” the ability of the schools to raise standards.

That included a lack of investment in professional development for staff, and a lack of investment in curriculum resources, a spokesperson added.

I completely agree that anyone guilty of financial impropriety ought to be (a) punished appropriately (which would mean at the very least being required to repay all relevant monies) and (b) prohibited from being involved in running schools in the future.

This definitely should apply to academies, but (and I can anticipate the eye-rolling here) we shouldn’t lose sight of the fact that financial impropriety happens in local authority schools as well – indeed it happens everywhere where people have the chance. Yes, let’s make sure that academies are being policed properly, especially because the sums involved can be so much bigger, but let’s not turn a blind eye to what happens in local authority schools and pretend that the past was a golden idyll of trustworthiness …

“The issues only came to light after the government ordered it to close down, and new trustees were appointed to oversee the transfer of its nine schools.”

If such issues can only be discovered AFTER a trust is closed down, it means the system is broken.

If those guilty are put in jail it will concentrate the minds of others tempted to steal money. At the moment there seems to be no real sanction if you hand over hundreds of thousands of pounds of public money to your associates.

Apart from the theft of money, do we really want people with no moral compass, running our schools?

A totally specious argument.

Just because, in this instance, the issues came to light after new trustees were appointed doesn’t mean that they wouldn’t have come to light if there were no new trustees. On what basis have you made the leap from this specific set of circumstances to the conclusion that such issues can ONLY be discovered after a trust is closed down?

Academy Trusts are required to have their accounts independently audited every year. If reputable accountants are used (and this may well be something that could be tightened up) they would not have simply signed off on this apparent financial irregularity and it would therefore have come to light in the same way.

Your comments about sending them all to jail are more interesting. As I said above I agree that guilty parties should be appropriately punished. But I’m interested in how far you’d go with sending people to jail if they steal public money from schools. NCTL give several examples of financial impropriety in schools:

(https://www.nationalcollege.org.uk/transfer/open/adsbm-phase-5-module-5-managing-strategic-finances/adsbm-p5m5-s4/adsbm-p5m5-s4t3.html)

In these instances headteachers (of local authority schools) were found guilty of ‘stealing’ thousands of pounds from schools – should they be sent to jail?

Mark – he answer to your question is Yes. Staff found guilty of stealing thousands of pounds from schools should be sentenced appropriately.

All but one of the NCTL examples were from 2003. One was found out by LA auditor. One was reported by a whistleblower. One was discovered when a head informed LA auditor re’ cavalier’ teacher. One school secretary was jailed for fraud.

One example was from 2012 at a Foundation school. The head and deputy were prosecuted for fraud.

I don’t disagree.

As for them all being from 2003, that’s probably around about the time when the NCTL paper was produced.

But as you point out, out of three examples of fraud only one was ‘properly’ discovered by the system and the other two came to light as a result of whistle-blowing. This seems to be similar to the situation we now have with academies – some fraud is discovered by the system but most is found out because of whistle blowers.

This isn’t an indictment of any particular system. Whoever commits fraud tries to do it in a way that won’t be discovered. It happened in 2003 in local authority schools (and I have no doubt is still happening) and it is happening in academies now.

Don’t misunderstand me – I am not excusing bad behaviour within academies in any way whatsoever. All I am trying to say is that it’s not limited to the academy sector.

Mark – LAs are now required to report fraud to the NAO. The first year this was done, 2014, there were 191 cases of fraud worth £2.3m in LA maintained schools in 2012/13. 105 of these were external fraud where the school was a victim. 86 were internal fraud costing £1.9m.

http://www.localschoolsnetwork.org.uk/2014/01/local-authorities-found-2-3m-worth-of-fraud-in-schools-but-do-they-like-the-efa-rely-too-much-on-whistleblowers

You’re right that academies have their accounts independently audited but it’s important to remember that some academy trusts who were later sent Financial Notices to Improve had had their accounts cleared by auditors (eg Durand, Sawtry, Cuckoo Hall).

And Academies are required to report fraud to the EFA.

Section 4.8.2 of the Academies Financial Handbook says “The trust must notify EFA, as soon as is operationally practical based on its particular circumstances, of any instances of fraud, theft and/or irregularity exceeding £5,000 individually, or £5,000 cumulatively in any academy financial year. Any unusual or systematic fraud, regardless of value, must also be reported.”

Therefore taking the line of your comments we can rest assured that whatever is reported to the EFA is the correct and accurate picture.

I don’t expect you to agree with that, and I don’t agree with it either.

Just as I don’t agree that we should simply believe what any organisation (local authority or otherwise) self-reports without a degree of cynicism and investigation.

I would pick up on your comments about the auditors though which I think is a really good one. Given the problems at all three of those named trusts, questions should be asked about whether the relevant auditors did their job properly.

According to the FRC: “Accountants and actuaries must comply with the technical and ethical standards; regulations, guidance and bye-laws of their professional body; and company law. A breach of or departure from any of these may render an accountant or actuary liable to disciplinary action by their professional body.”

So the good news is that it’s not all on the EFA/DfE’s plate again. A complaint can be made to the Institute of Chartered Accountants in England and Wales who can discipline firms if their professional conduct “falls below the standard to be expected.”

Yes. Both maintained and academy culprits should see the inside of a HMP and a number of heads, assistant heads and other staff from maintained hhave served prison sentences. I don’t recall this happening academies

“The founder of a flagship free school has been jailed for five years for fraudulently obtaining thousands of pounds from Department for Education grants. Sajid Hussain Raza, 43, was jailed at Leeds crown court along with two of his former staff members, Daud Khan and Shabana Hussain, who were sentenced to 14 months and six months respectively.”

From The Guardian: https://www.theguardian.com/education/2016/sep/30/bradford-free-school-founder-jailed-for-defrauding-government

Typed in “academy fraud jailed” into Google. Wasn’t a strenuous bit of research.

what happened to the bankers following their financial management ?. . . the same will happen here