A two-year run of cash-strapped academy trusts eating into their reserves has come to an end, with the largest MATs recording gains of over £1 million.

But the Kreston group, a network of accountancy firms, has warned leaders not to “pop the champagne”, as most trusts expect to dip into their saving by as much as 43 per cent by 2028.

It comes after a Schools Week investigation last month revealed more trusts bolstered their reserves last year – with one registering a 900 per cent boost.

Here’s what you need to know from Kreston’s academies benchmark report for 2026…

1. Reserves boost

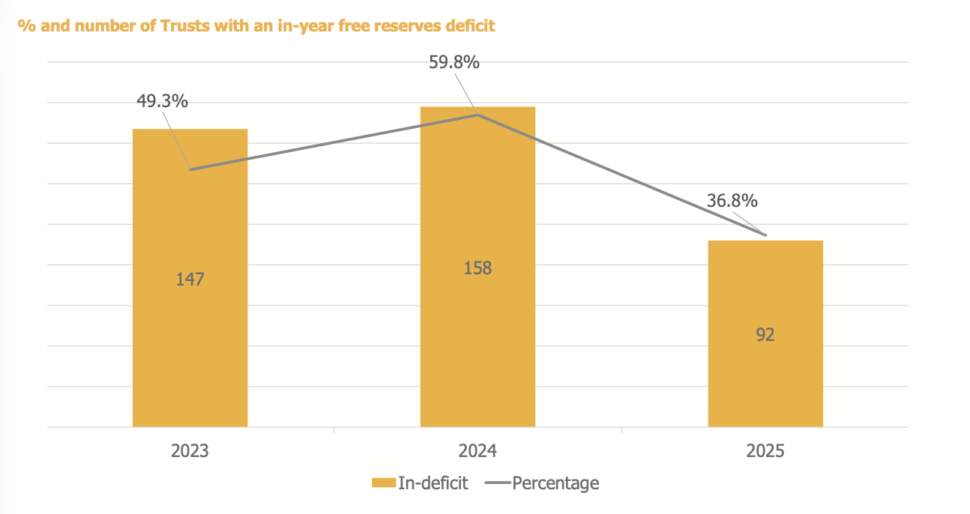

Only 37 per cent of trusts returned an in-year deficits in 2024-25, down from 60 per cent 12 months earlier.

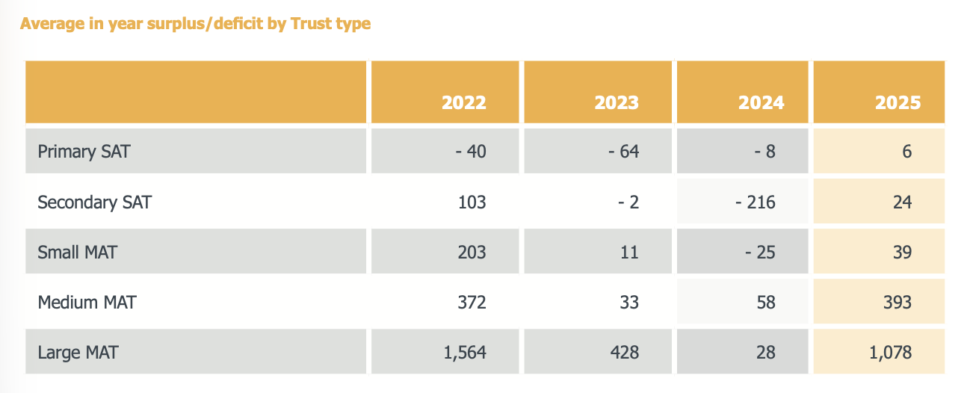

The biggest MATs recorded in-year surpluses of £1.1 million on average. The figure stood at £28,000 the year before.

This comes after Kreston had seen “an ever-greater proportion” of academy chains dipping into reserves in 2023 and 2024.

The study – which involved 250 trusts running almost 2,500 schools – attributed this to the sector being given a “pleasant surprise” by government, which covered “a little more of the [teacher] pay rise … than expected”.

“In a sector where the finances are so finely balanced then this can make all the difference,” the report explained.

Kreston also found 26 per cent of trusts are sitting on reserves that represent less than 5 per cent of income, down from 35 per cent in 2023-24.

The Department for Education recommends trusts hold reserves of at least 5 per cent of total income. Twenty per cent above that level is considered too much.

2. …but don’t ‘pop the champagne’

However, Kreston added it was “worth emphasising that for the [single academy trusts] and small MATs these surpluses are still very modest”, ranging from £6,000 to £39,000, before “we pop the champagne corks”.

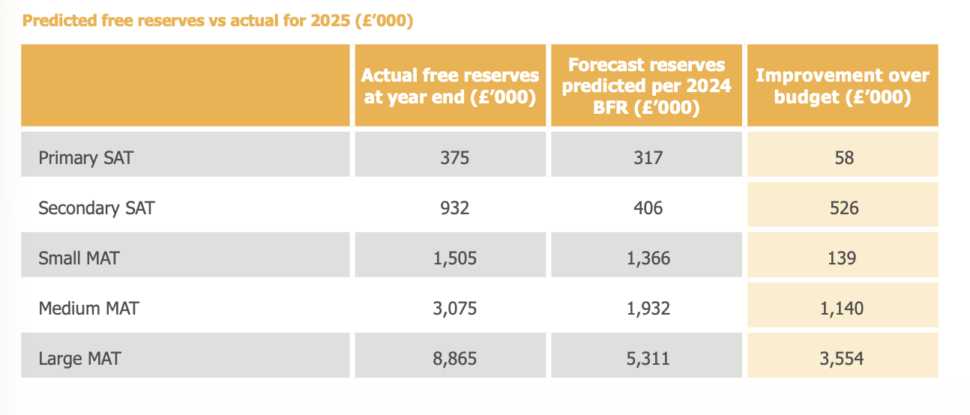

There also remains “a great deal of uncertainty”. All trust types, except medium-sized MATs, are forecasting reserves to fall by up to 43 per cent over the next two years.

Kevin Connor, a report author and head of academies at Bishop Fleming, said this shows “continuing uncertainty are already weighing on confidence and limiting trusts’ ability to plan, invest and grow”.

“On the face of it, academy trusts have had their strongest financial year since 2022.

“However, surpluses have been largely propped up by tighter budgeting and in-year funding trusts were not expecting when they set their budgets, rather than by any easing of underlying financial pressures.”

3. Call for forecast rethink

Despite this, the report stressed trust forecasts “need to be taken with a large pinch of salt”. The “accuracy” of budgeting “is not particularly reliable”, with trusts tending to err on the side of caution.

Kreston believes this raises questions over “whether trusts are making poor decisions” based on the projections and if there’s “any real value” in the forecasting process for schools or the DfE.

“We have had a number of conversations with our clients where they didn’t think they could afford to replace a teaching assistant but then went on to make a surplus for the year.

“Had they had reliable financial information then, in many cases, these roles could have been replaced.”

Kreston called on the DfE to provide leaders “with a longer-term income plan … on a timely basis”. This “would have the potential to transform the budgeting process and lead to better decisions”.

4. Growth stalls

Thirty-six per cent of trusts are expecting to expand this year, down from 61 per cent 12 months ago, according to Kreston.

Connor said that “low confidence across the sector has dampened growth predictions”, amid “serious concerns” over “whether trusts have the funding and resources they would need to turn schools with complex challenges around”.

5. Investment gains

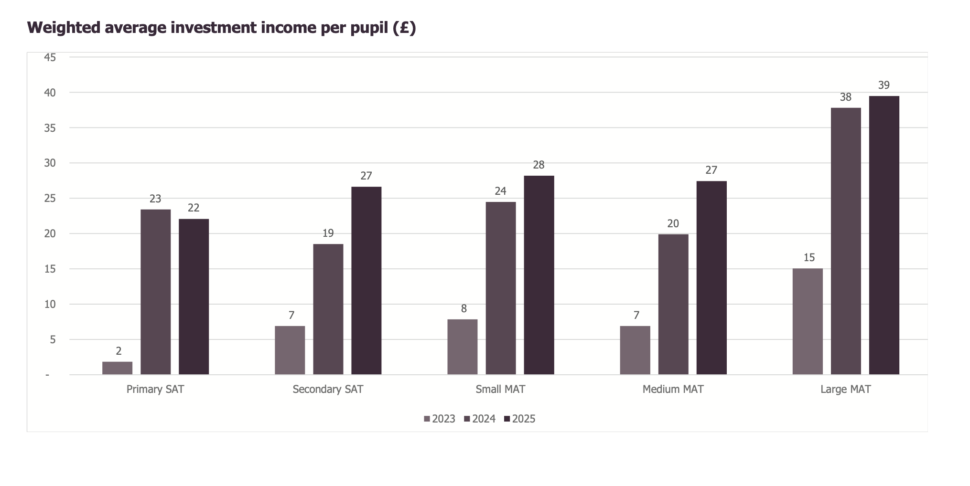

The research shows trusts have also cashed in on “sustained high interest rates over the past four years”.

On average, trusts generated investment income of £33 per pupil last year, up from £29 per pupil in 2023-24. Large MATs returned the most (£39 per pupil).

Kreston said the figures reflect “the sector’s ongoing commitment to maximising income and strengthening financial resilience”.

6. Staff cost pressures

Just under 90 per cent of trusts responding to a Kreston survey listed staff costs as one of their top three concerns this year, up from 81 per cent.

Its analysis shows teaching and support staff salaries now account for over 75 per cent of total income, a commonly used benchmark for financial health, for all trust types.

“It is interesting that there is also no meaningful gap between SATs and MATs in terms of this metric, which suggests that in absolute terms size is having little impact on this as everyone is in the same position.”

7. £200k CEO pay average

The report shows the CEOs of the largest MATs are earning over £200,000 on average. This figure stood at £189,000 last year.

But CEO pay for all types of trusts, except primaries, “have seen growth that is, on average, consistent”, with the range “not significantly different to previous years”.

8. Net zero target ‘in doubt’

Kreston warned the “current pace of change” in school carbon emissions “raises questions over how achievable” the government’s 2050 target for full net zero is for “many” in the sector.

Trusts generated 0.184 tonnes of CO2 emissions per pupil last year, which only represents a slight improvement on figures last year.

Your thoughts