Private schools have reduced their fees and increased bursaries after Labour removed their tax breaks, as data shows pupil numbers have dropped by 13,000 in a year, well above government estimates.

The Independent Schools Council has published its annual census, its first since ministers began charging VAT on fees and making private schools pay business rates.

Mark Taylor, interim chair of the ISC, said it showed the “triple whammy” on independent school finances, the third being the rise in national insurance employer contributions.

“This series of political decisions is unprecedented,” he said, stressing the importance of data to ensure “black and white” evidence of their repercussions.

A negative impact of tax raids on private schools has been widely feared by the sector, with national headlines warning of a major “private school exodus”.

The education secretary, meanwhile, this week told Times Radio private schools had “cried wolf”.

Bridget Phillipson accused them of “whack[ing] up their fees year on year, way beyond inflation” and said it was for them to “justify their decision-making around the level of fee that they set”.

According to the Institute for Fiscal Studies, private school fees rose by 24 per cent in real-terms between 2010 and 2020.

1. Pupil numbers plunge more than expected …

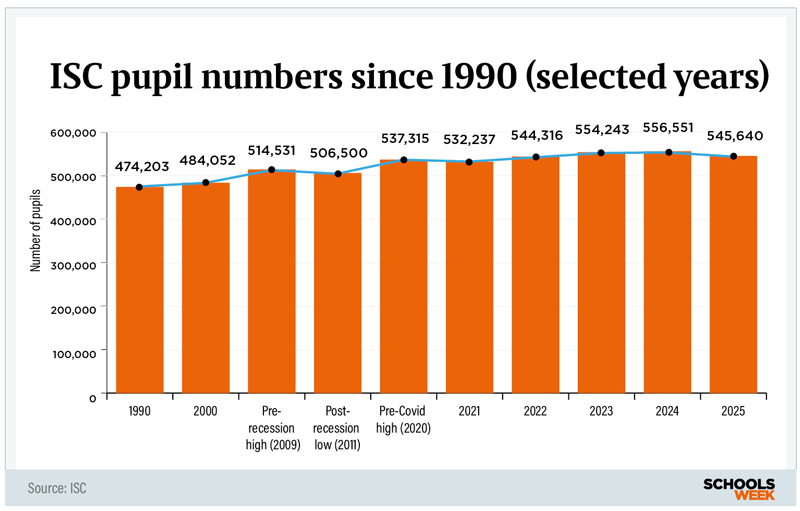

At 1,380 ISC members that participated in both the 2024 and 2025 censuses, pupil numbers dropped by 2.4 per cent, or around 13,000.

The government had estimated there would be around 3,000 more pupils in the state sector as a result of the introduction of VAT, with another 300 expected because of business rates.

However, the decrease from 551,578 to 538,214 takes numbers closer to the population seen in 2022 – 544,000, though the drop is more than double the 5,000 decrease seen after the pandemic hit in 2021.

The figures show London private schools experienced the smallest change in pupil numbers (-1.5 per cent), followed by the south east (-2.3 per cent). Areas in the north and Midlands recorded the largest drop, of all areas in England.

2. … but what is falling roll impact?

Part of the decrease could however be due to falling pupil rolls.

Primary school pupil numbers have been falling nationally since 2018-19, while secondary school pupil numbers are forecast to keep growing until 2027-28, due to a population bulge moving through the school system.

Across state primary schools in the England, Scotland and Wales, pupil numbers fell by 0.8 per cent between 2022-23 and 2023-24, while secondary school pupil numbers increased by 1 per cent.

The ISC data shows private school pupil numbers fell across both primary and secondary in the last year, but the drop was more significant in primary school.

The standard intake years for primary and secondary – Reception and Year 7 – both showed reductions of 5.1 per cent. But four of the five largest percentage decreases happened in the primary years, between Reception and Year 3.

The ISC report said: “There has been a recent decline in the UK population in this age range, but that does not explain the whole decrease”.

3. Schools reduce fees after VAT hike

This year, all private schools were required to add 20 per cent VAT onto their fees from January 1.

ISC data shows that the average fee rise in September 2024, before the VAT change hit, was 6.7 per cent.

However, when the January VAT change came in, schools then reduced their fees on average by 5 per cent.

This means that “on average, schools passed on in effect 14 per cent VAT to parents”, the ISC said.

Looking solely at day fees – and excluding SEND schools where fees can differ depending on a child’s needs – two-thirds (69 per cent) of ISC schools reduced their fees in January.

More than one in 10 schools (88 schools, or 10.2 per cent overall) reduced their fees by between 10 and 20 per cent – with another 0.6 per cent of schools (five schools in total) reduced their fees by more than 20 per cent.

The majority of schools lowered their feed by up to 10 per cent. Around one-third did not change their fees.

Meanwhile a very small number (1.3 per cent) increased fees.

Across all schools that completed the census in January 2024 and 2025 – again discounting special needs schools and nursery fees – this marks an overall average fee increase of 1.4 per cent, excluding VAT.

4. Despite concerns, private school bursaries rise

Despite national reports that private schools would no longer be able to afford bursaries because of the VAT raid, many have actually increased the amount of help they give pupils with fees.

The ISC census shows 34.5 per cent of all independent school pupils (more than 183,000) currently receive help with their fees. This equates to more than £1.5bn – an increase of 11.4 per cent on last year’s support.

A “significant majority” (73 per cent) of this comes directly from the schools. ISC schools provide fee assistance worth more than £1.1bn annually – an increase of £3.9 per cent compared to last year.

Other support comes from sources such as local authorities and the government.

The ISC data shows fee assistance has been generally increasing since 2000.

In 2024-25, 39,090 pupils received means-tested bursaries and scholarships. Of these, 13,260 covered 76 per cent to 100 per cent of fees.

In 2023-24, 41,492 pupils received such support. But slightly fewer received higher-level support. That year, 13,042 received 76 to 100 per cent scholarships and bursaries.

Taylor said this shows that “even under the most acute pressure, schools have maintained their commitment to educate the widest possible range of children”.

“Last year, a record amount was spent helping families to afford the fees. This year, that record has already been broken: overall fee assistance has increased by 11 per cent.”

Labour used OBR predictions about number of lost places for private schools, and they reported it at 6% reduction.

Further confirmed by institute of fiscal studies which said it would be at least 3% worst case 7%.

And it is actually under 3%. Strange the right wing are now claiming that this was higher than Labour predicted as it is clear under Labours predictions. Articles written in 2024 state they predict 6% and still come out with a benefit of 1.7 bn.

It seems there’s been some confusion over the numbers. Labour initially claimed the reduction in pupil numbers would be just 3,000 in the first academic year following the VAT change. In reality, the actual figure was over 13,000—a difference of more than 333%.

Then there’s the issue of the widely cited 6% (37,000) figure. Labour presented this as the total long-term impact, but even that was misleading. Thanks to a recent High Court case, we’ve learned the government’s internal estimate was actually 54,000—a figure they were forced to release.

So why is the government clinging to the lower “power number”? Because a 10% drop in pupil numbers is widely seen as the threshold where the VAT policy begins to lose money for the Treasury, once displaced pupils shift into taxpayer-funded education.

As for the IFS report that came out later—it has raised eyebrows. Not only was it released after the government data, but it was authored by someone with close personal ties to a Labour MP. It also introduces some rather questionable economic assumptions—like the idea of an ‘opportunity cost’ to charging VAT, while ignoring the fundamental economic principle that all decisions are made at the margin. Frankly, it’s an embarrassing attempt to prop up a weak policy.

Let me know if you’d like a more formal version or if this is being directed to a particular audience (e.g. parents, governors, policymakers).

It was catastrophic for me I was a disabled employee in a private school in a revenue generating role but my post was made redundant to apparently save the school money!

Boo hoo

The UK has the distinction of being the only country in the world to charge VAT on education. Labour no longer believe that education is a necessity or human right, to them it’s a luxury. Along with warmth for pensioners, jobs for fishermen and help for the disabled. But oh – its all the fault of the Tories. So children have to leave School, the elderly die of hyperthermia and the disabled crawl so that Rachael from accounts can balance the books.

Welĺ there’s a synthetic response. The true impact of this left wing idiotic policy will be evident in September 2025. They have promised to fund 6000 extra teachers to the state sector but infact it will cost them dear, with state schools having to fund extra teachers and resources to cope with the influx. Again a badly, and frankly stupid idea from a badly prepared Labour Goverment that are lacking in business acumen, just like thier chancellor of the exchequer.

The mid-academic year implementation of the VAT decision on school fees prompted many parents facing affordability challenges to keep their children in private schools for the remainder of the year. Consequently, a significant decline in private school enrollment is anticipated by September, which could have substantial negative impacts on the sector, potentially leading to school closures.