Private firms have posted profits totalling tens of millions of pounds since 2012 from selling their stake in government-awarded contracts to build schools – while company directors pocketed seven-figure salaries.

The guaranteed yearly rise of PFI repayment costs is heaping more pressure on schools as their budgets are tightened by the public sector squeeze.

But an analysis of annual accounts and publically available documents has found business is booming for firms running the projects. A process known as “flipping” – where building firms sell on the value of their equity in PFI projects to other companies – came under scrutiny as part of the public accounts committee’s 2011 investigation.

Former committee chair Margaret Hodge (pictured right) said firms were making excessive profits, which critics say should be shared with taxpayers.

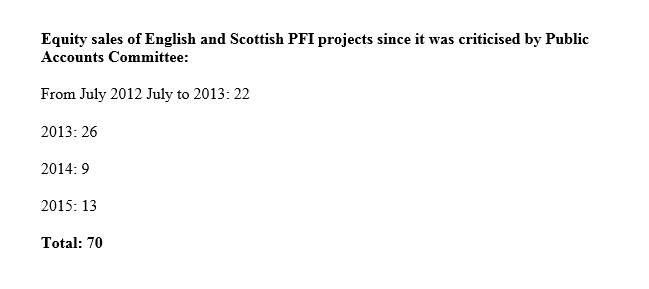

Schools Week can reveal – despite the public criticism – at least 70 school PFI projects have been flipped from July 2012.

The data, not yet published, will form part of an updated PFI database by the social justice not-for-profit organisation European Services Strategy Unit (ESSU).

Building firm Balfour Beatty made nearly £50 million from selling its shares in two PFI deals.

In April 2013, the firm sold its 50 per cent stake in four PFI schools projects to its partner in the projects, investment group Innisfree (see left). The total sale was

£42.5 million – making a profit of £24.4 million for the builder.

The construction firm made another £24 million profit from selling its 100 per cent stake in the Knowsley schools PFI project. It was sold for £42 million in May 2014 to investment fund Dalmore Capital, seven years into a 27-year contract.

Interserve also made £60 million profit by selling half its stake in 19 PFI projects – four of which were schools in Plymouth, St Helens, Sandwell and Leeds – to Dalmore Capital in October 2012.

Schools Week was unable to ascertain from publically-available documents how much of this profit could be attributed to school projects.

The PAC, in its report, “Lessons from PFI and other projects”, said it had heard evidence tax revenue was being lost because of the offshore arrangements of some of the investment companies snapping up contracts.

The PAC, in its report, “Lessons from PFI and other projects”, said it had heard evidence tax revenue was being lost because of the offshore arrangements of some of the investment companies snapping up contracts.

And Schools Week has found 40 of the equity deals since 2012 have been acquired by offshore infrastructure funds, including in tax havens such as Jersey, Guernsey and Luxembourg.

Professor Dexter Whitfield, the director of ESSU, which compiles the data, said PFI contracts were expected to deliver a 12-15 per cent rate of return for the private sector. But the National Audit Office, as part of its review in 2012, found investors selling their shares in equity early resulted in returns of between 15 and 30 per cent on their original investment.

Professor Whitfield said: “This reveals a scandalous exploitation of taxpayers’ money.”

Philip Nye contributed research

OTHER STORIES FROM OUR PFI INVESTIGATION:

Investigation: Who will pick up the PFI tab?

Revealed: The true scale of school PFI debts

The future: Fair Funding Formula could be toxic for PFI schools

The future: Will schools get a better deal under PF2

The PFI firms: The low-key investment firm that owns 260 UK schools

Those that have taken money to build schools to a particular standard and then do not deliver against those standards are knowingly and deliberately putting children at risk, their education if not their very safety. Under such breach of contract these projects should be taken into public ownership with extreme prejudice. Those responsible for the shortcomings should be offered the opportunity to break big rocks into little rocks at her Majesty’s pleasure in an attempt to transform their souls.

Those in local and central government who connive with such people to cover up the failings of such ill considered purchasing decisions to save face for themselves or for the corporate identity of the local authority (whose corporate identity should only exist insofar as it serves the public good) by allowing some degree of restitution to fix problems but with no penalties, should be investigated for conspiracy either for the apparent fraudulent intent itself or to cover it up for whatever purpose.

This might seem unreasonable and for an isolated case (a mistake) it would be, but 17 projects, 17 sets of issues, speaks to a methodology to oversell and under deliver; bad enough in any honourable area of business but where children are concerned – utterly unacceptable.

One of the worst aspects of PFI is the way the real cost is buried in school budgets where it can’t be seen. Worse still, this cost is paid by squeezing the teaching & learning resources, or the education of the pupils. It’s great to have the profits of these companies exposed, but we must demand total transparency of the cost to education. How much more has PFI cost us compared to what it would have cost if we had found the capital cost ourselves and trusted the running of the schools to school leadership as we do for publically owned schools. Some sort of public enquiry is required, and for the whole PFI scandal in education, not just Scotland. This is not a Scottish problem. Their issues are symptomatic of a greedy, broken financial mind set, and the problems are likely to exist wherever these types are allowed to play.

When we can print £100Bs to underwrite the bonuses and pensions of the very people that caused the financial crisis, can’t we at least afford a measly few £billion to buy back our schools? I know what I consider to be the best value investment.